The Rise of Bitcoin Derivatives: Futures and Options

The Rise of Bitcoin Derivatives: Futures and Options

What are Bitcoin Derivatives?

Bitcoin derivatives are financial contracts that derive their value from the price of Bitcoin. They allow investors to speculate on the future price movements of Bitcoin without having to own the underlying asset. Two popular forms of Bitcoin derivatives are futures and options.

Understanding Bitcoin Futures

Bitcoin futures are contracts that obligate the buyer to purchase or the seller to sell Bitcoin at a predetermined price on a specific date in the future. This provides traders with an opportunity to profit from both rising and falling Bitcoin prices.

Key Features of Bitcoin Futures:

- Standardized contracts traded on regulated exchanges like the CME Group and Bakkt.

- Settlements are done in cash, not physical delivery of Bitcoin.

- Offered in different contract sizes and expirations to suit various trading strategies.

Benefits of Bitcoin Futures:

- Leverage: Traders can amplify their gains or losses by using borrowed capital.

- Hedging: Investors can protect their Bitcoin holdings from price volatility.

- Market Efficiency: Futures trading adds liquidity and price discovery to the Bitcoin market.

Exploring Bitcoin Options

Bitcoin options are derivative contracts that grant the buyer the right, but not the obligation, to buy or sell Bitcoin at a specified price within a specific timeframe. Options provide traders with flexibility in their investment strategies, allowing them to profit from both rising and falling Bitcoin prices.

Key Features of Bitcoin Options:

- Unlike futures, options trading is not yet widely available on regulated exchanges.

- They provide traders with the right, but not the obligation, to buy or sell Bitcoin.

- Options have expiration dates, after which they become worthless.

Benefits of Bitcoin Options:

- Limited Risk: The risk is limited to the price paid for the option.

- Profit Potential: Options offer the potential for unlimited gains in the event of a favorable market move.

- Protection: Options can act as an insurance policy to protect against adverse price movements.

FAQs

Q: Are Bitcoin derivatives regulated?

Yes, Bitcoin futures are traded on regulated exchanges and subject to oversight by governmental authorities. However, Bitcoin options are currently not regulated in most jurisdictions.

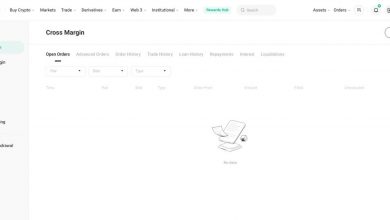

Q: Can I trade Bitcoin derivatives on any exchange?

No, not all exchanges offer Bitcoin derivatives trading. It is important to choose a reputable exchange that is regulated and has a track record of security and fair trading practices.

Q: Is trading Bitcoin derivatives suitable for beginners?

Bitcoin derivatives can be complex financial instruments, and they carry a higher level of risk compared to spot trading. It is advisable for beginners to gain a solid understanding of Bitcoin before venturing into derivative trading.

Q: What impacts the price of Bitcoin derivatives?

The price of Bitcoin derivatives is influenced by factors such as the supply and demand of the underlying asset, overall market sentiment, regulatory developments, and macroeconomic indicators.

Q: How can I get started with Bitcoin derivatives trading?

To start trading Bitcoin derivatives, you’ll need to open an account with a suitable exchange, complete the necessary verification process, deposit funds, and familiarize yourself with the trading platform and the associated risks involved.

As you can see, the rise of Bitcoin derivatives, particularly futures and options, offers intriguing opportunities for traders and investors. However, it’s crucial to approach derivative trading with caution and acquire a strong understanding of the mechanisms and risks involved.