How to Set Up Interac ID for a Seamless Payment Experience

How to Set Up Interac ID for a Seamless Payment Experience

Introduction

In today’s digital world, having a seamless and secure payment experience is essential. Interac ID is a popular payment method that allows you to make quick and easy transactions online. In this blog post, we will guide you through the process of setting up your Interac ID and help you enjoy a hassle-free payment experience.

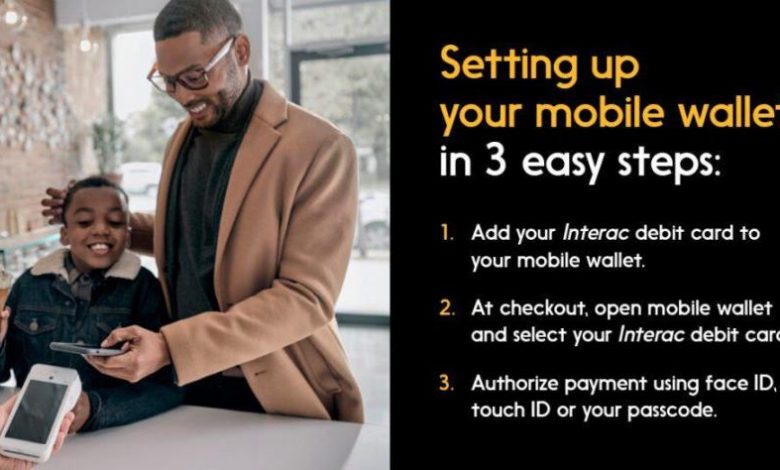

Step-by-Step Guide to Set Up Interac ID

Step 1: Open your banking app

To set up Interac ID, you need to have a bank account with a participating financial institution. Open your banking app on your smartphone or log in to your online banking account through your computer.

Step 2: Navigate to the Interac ID setup

Once you are logged in to your banking app or online banking account, navigate to the payment or transfer section. Look for the Interac ID setup option. It may vary depending on your bank’s interface, but it’s usually found in the settings or profile section.

Step 3: Select a personal identification question

During the setup process, you will be prompted to select a personal identification question. Choose a question that only you know the answer to as this will be used for additional security measures.

Step 4: Create a secure Interac ID

Next, create your Interac ID. This will be the unique identifier that you will use for online transactions. Choose a memorable and secure Interac ID, but avoid using personally identifiable information or easily guessable details.

Step 5: Link your bank account

Before you can start using Interac ID, you need to link your bank account. Follow the instructions provided by your banking app or online banking platform to securely link your account. This step may require you to enter your account details or provide additional authentication.

Step 6: Confirm your setup

Once you have completed the above steps, review the information you provided and confirm your Interac ID setup. Take note of any additional instructions or security measures provided by your bank during this process.

Frequently Asked Questions (FAQs)

Q1: Is Interac ID available for all banks?

Yes, most major Canadian banks offer Interac ID as a payment option. However, it’s always a good idea to double-check with your bank to ensure Interac ID is supported.

Q2: Can I use Interac ID for online shopping?

Yes, Interac ID can be used for online shopping. Many e-commerce websites and platforms accept Interac ID as a payment method. Look for the Interac logo or check with the merchant to ensure they support Interac ID.

Q3: Is there a fee to set up Interac ID?

No, setting up Interac ID is typically free of charge. However, certain transactions or services may have associated fees. It’s always a good idea to review your bank’s fee structure to understand any costs that may be applicable.

Q4: How secure is Interac ID?

Interac ID follows stringent security protocols to ensure the safety of your transactions. It uses industry-standard encryption and authentication measures to protect your personal and financial information. Additionally, setting up a unique and strong Interac ID, as mentioned in the guide, adds an extra layer of security.

Conclusion

By following these simple steps, you can set up your Interac ID and enjoy a seamless payment experience. Remember to choose a secure Interac ID and keep your banking app or online banking credentials safe. With Interac ID, you can make online transactions with ease and confidence.

Whether you’re shopping online or transferring funds to friends and family, Interac ID is a convenient and secure payment method. Take advantage of this service and simplify your digital payments today!

Are you ready to set up your Interac ID? Share your experiences and thoughts in the comments below!